The annual confirmation of RCBE data must be made by 31 December 2022, if any any updates to the information in the RCBE must change it within 30 days of the event.

If you made a change in the same calendar year, there is no need to confirm.

A annual confirmation can be submitted with the Simplified Business Information (IES) for the previous calendar year, or by submitting an update declaration on the RCBE website.

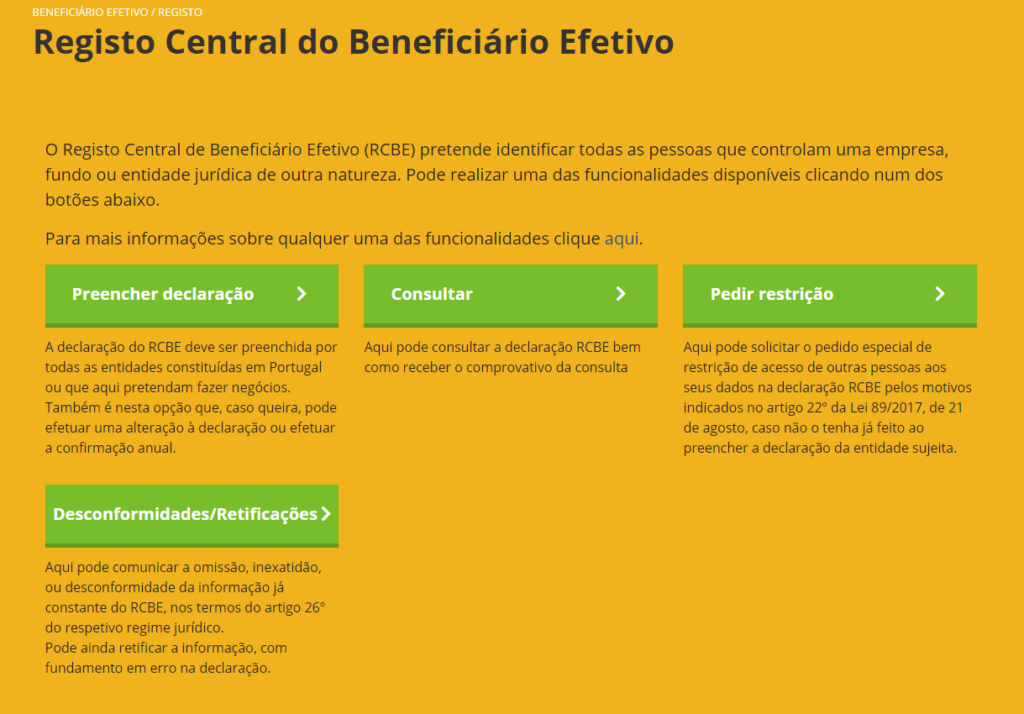

What is the RCBE?

The acronym RCBE stands for Central Beneficiary Register and is an obligation that declares who the beneficial owners are. In this sense, beneficial owners are all those who control, by means of shareholdings or other means provided for in Article 30 of the Law. Law 83/2017 of 18 August, a companybusiness entity, civil society, co-operative, association, foundation, fund or a trust.

In order to prevent fraud, this declaration was created so that it is compulsory to identify the organisation's actual beneficiaries.

This declaration is requested 30 days after the commercial register, i.e. after a company has been created, and must be updated whenever there are any changes to the information contained in this declaration.

The penalties The penalties for non-compliance include, in addition to fines of up to €50,000.00, being barred from tendering for public services or benefiting from European funds.

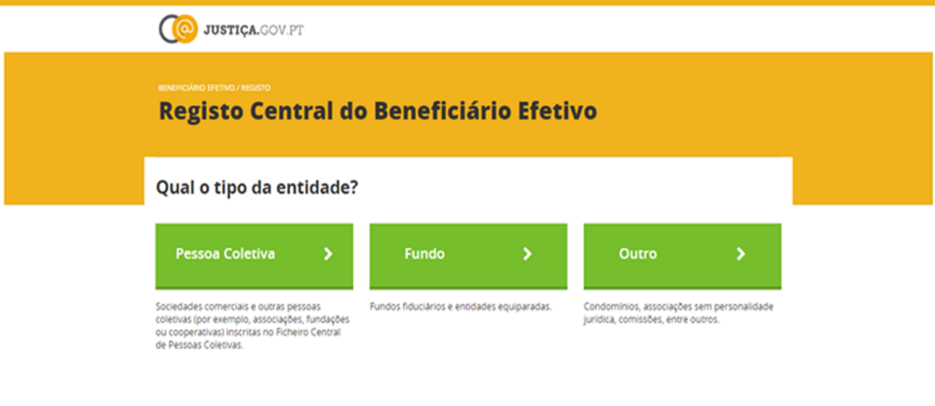

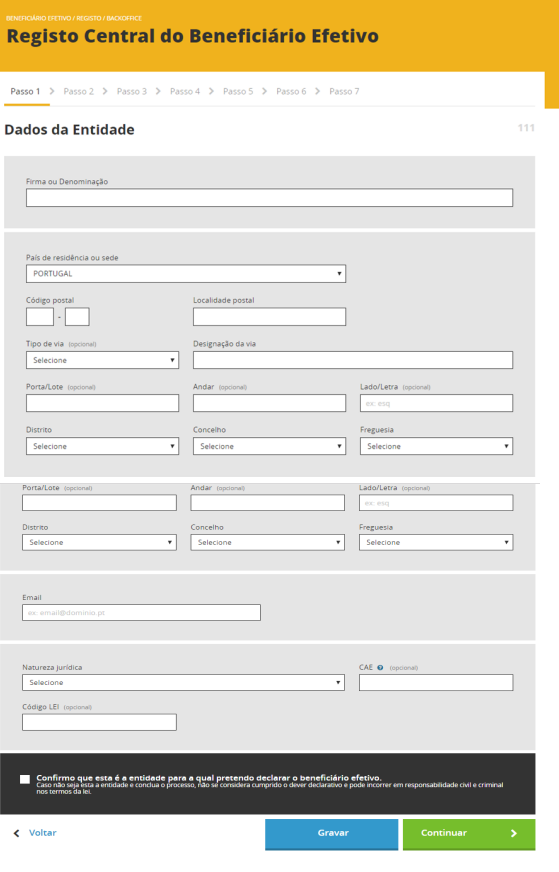

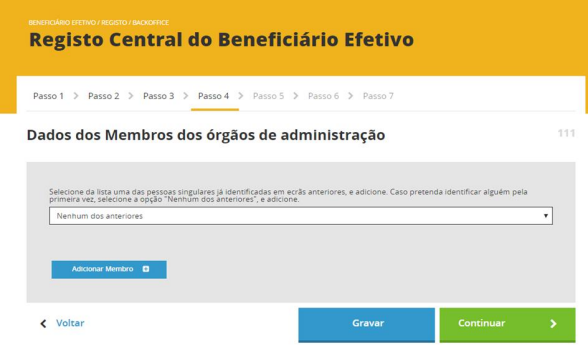

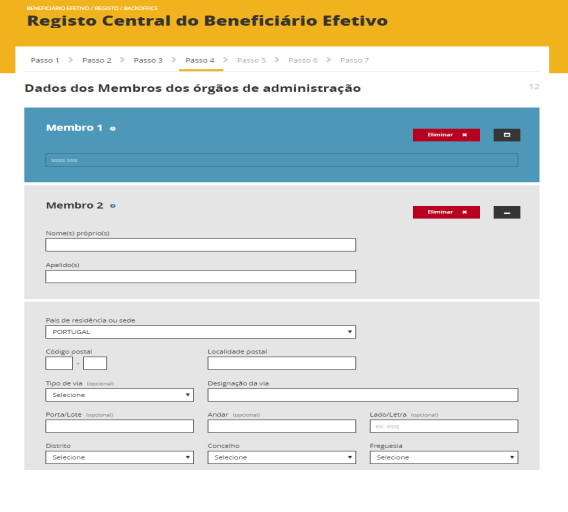

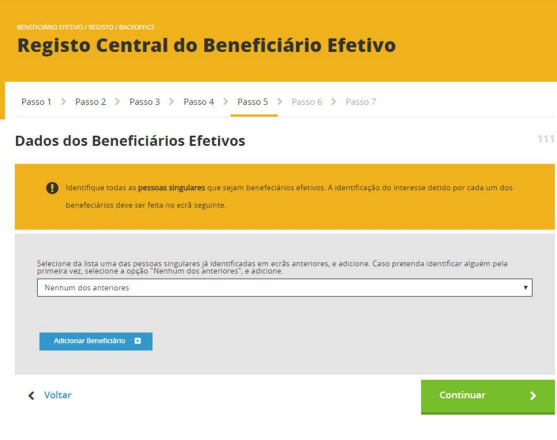

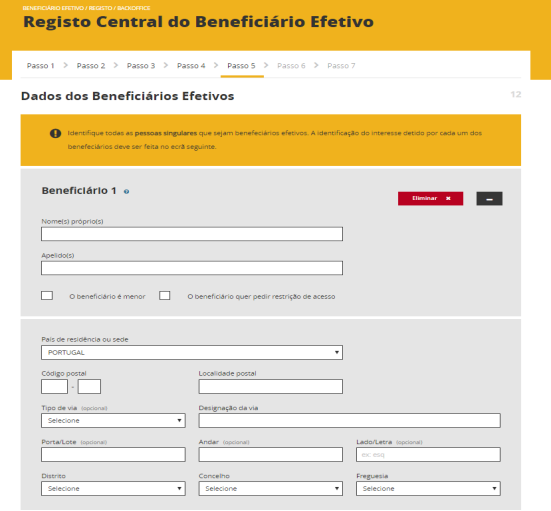

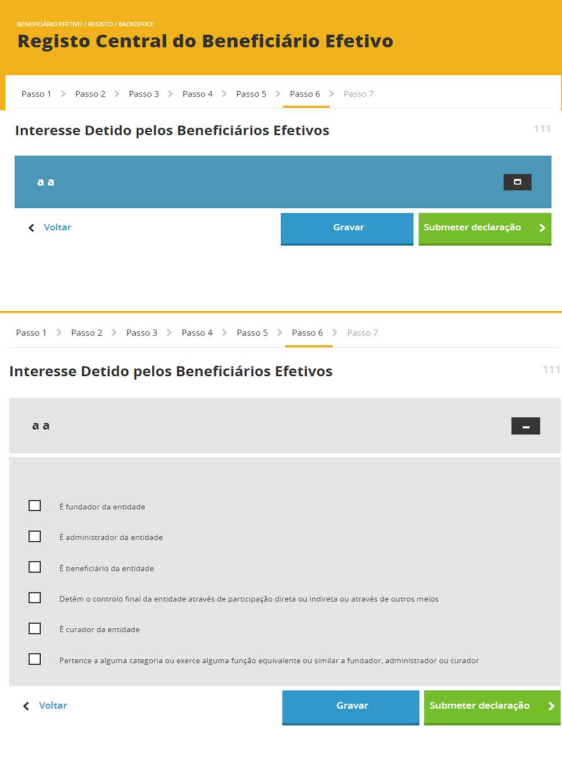

Filling in the RCBE step by step

To fill in the RCBE, go to here and follow these steps:

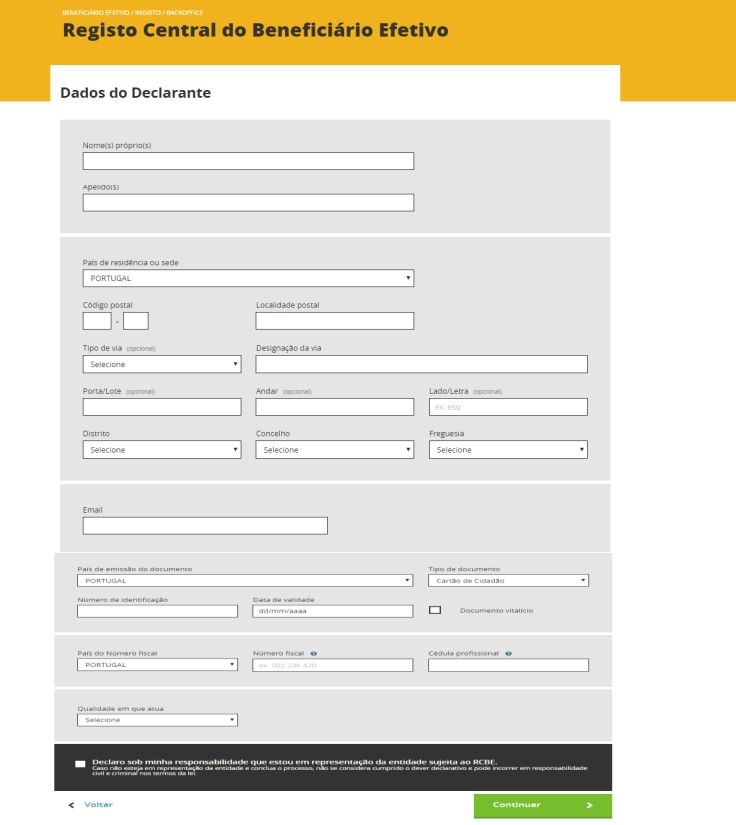

How do I make the change?

To amend or correct previous declarations, go to here and follow these steps:

- Choose the "Fill in declaration" option

- Authenticate yourself with your means of authentication (CC/CMD or professional certificates)

- Choose the "Update/Change" option

- Search for the organisation and enter the RCBE code received when submitting the previous declaration, or if it is the same declarant, simply indicate that it has no RCBE code.

Note: The identification of the holders of shareholdings / partners and managers / administrators / directors who are notEffective Beneficiaries is no longer included in the RCBE declaration, so it is not compulsory to update these elements.

Source: IRN