The deadline for confirming or updating the householdor communicate any changes, is until the day 15 February.

The household needs to be updated on a regular basis to reflect the changes in your family situationThese include births, deaths, marriages, divorces and changes of residence. Updating the household in 2023 is important to ensure that the data is accurate and complies with current legislation and regulations. In addition, it may be necessary for access benefits and services which depend on up-to-date household information.

Communications you should make, if any:

- Wedding

- Births

- Divorce or separation (in the case of a civil partnership);

- Buying your own permanent home;

- Children who are no longer considered dependents (for example, because they have reached the age of 26 or have earned more than €9,870 per year);

- If you have dependants in joint custody with alternate residence, established in an agreement regulating the exercise of parental responsibilities.

Who are considered dependents in the IRS

They are considered dependents:

- Children, adoptees and stepchildren smaller not emancipated or under guardianship

- Children, adoptees and stepchildren larger as long as they are not more than 25 years old and do not receive more than 14 minimum wages per year (9,870 euros in the 2022 IRS)

- Children, adoptees and stepchildren most unfit to work and earn a living;

- Civilian children.

Thus, for the 2023 IRS, those who reach the age of 26 or who received more than €9,870 in total in 2022 will no longer be considered dependents.

Note: Dependents cannot be part of a household at the same time.

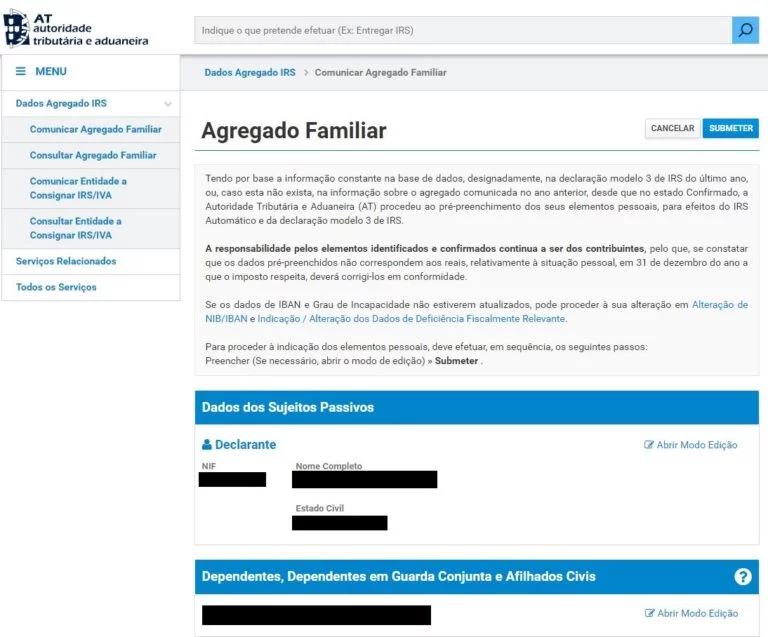

How to report your household to the tax office

Go to Finance Portal:

Step 1

Log in to the portal by entering your NIF and password or using your digital mobile key.

Step 2

Update the necessary information in the "Open Edit Mode" or review all the data and select "Submit".