Validate invoices in e-fatura IRS: We remind you that the deadline for validation of invoices in E-Fatura is even 25th February.

Although most expenses are reported automatically, depending on the sector of activity, there are some that must be validated manually in order to guarantee deductions and make the IRS refund.

In this article we explain step by step how you can do it!

Step 1: give in to e-Invoice and click on "IRS Deductible Expenses".

Step 2:Access the consumer area.

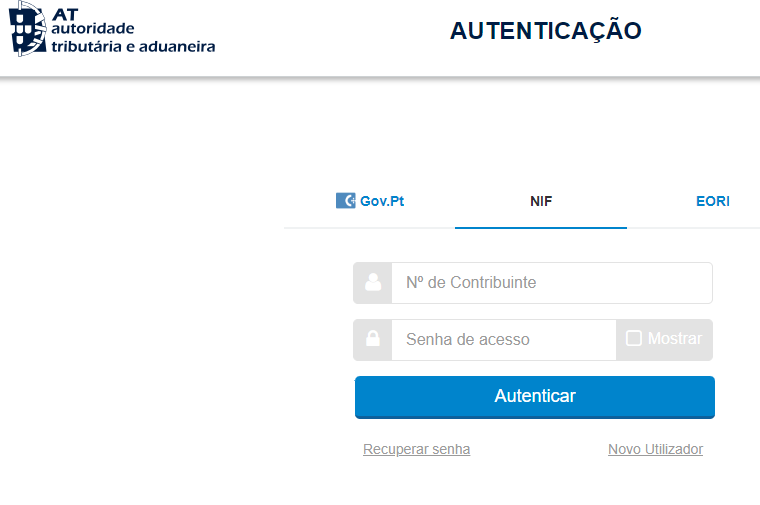

Step 3: Go to the Finance Portal.

You will then be redirected to the Finance Portal where you must enter your tax number and password or access it using your digital mobile key.

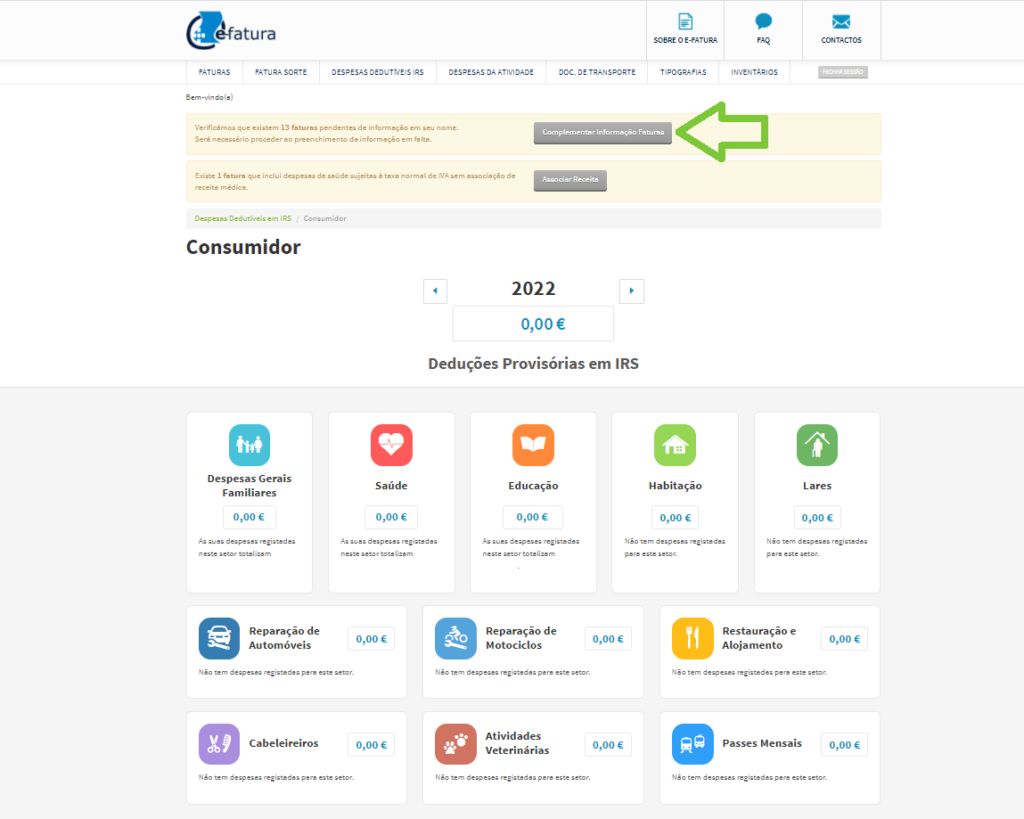

Step 4: Validate outstanding invoices.

If you have any outstanding invoices, you will see this when you enter the E-Fatura portal. To validate the invoices, click on "Complement Invoice Information".

Note: This happens when expenditure has been reported by a trader with more than one economic activity.

Step 5: Indicate the activity involved in making the purchase.

On each invoice select the activity and make the purchase and then indicate whether it was carried out within the framework of the professional activityin full or in part. Finally, to make the changes, click on "Save".

If you have any questions, please get in touch with us.