The government has put the brakes on rent increases by setting a value of 1.02, but landlords can still be protected through extraordinary support for landlords. reducing the tax burden.

On 21st October, the Law no. 19/2022The coefficient used to update the rents of the various types of existing lease for 2023 is 1.02 (2%). This value can always be different, as long as it is agreed between the parties involved.

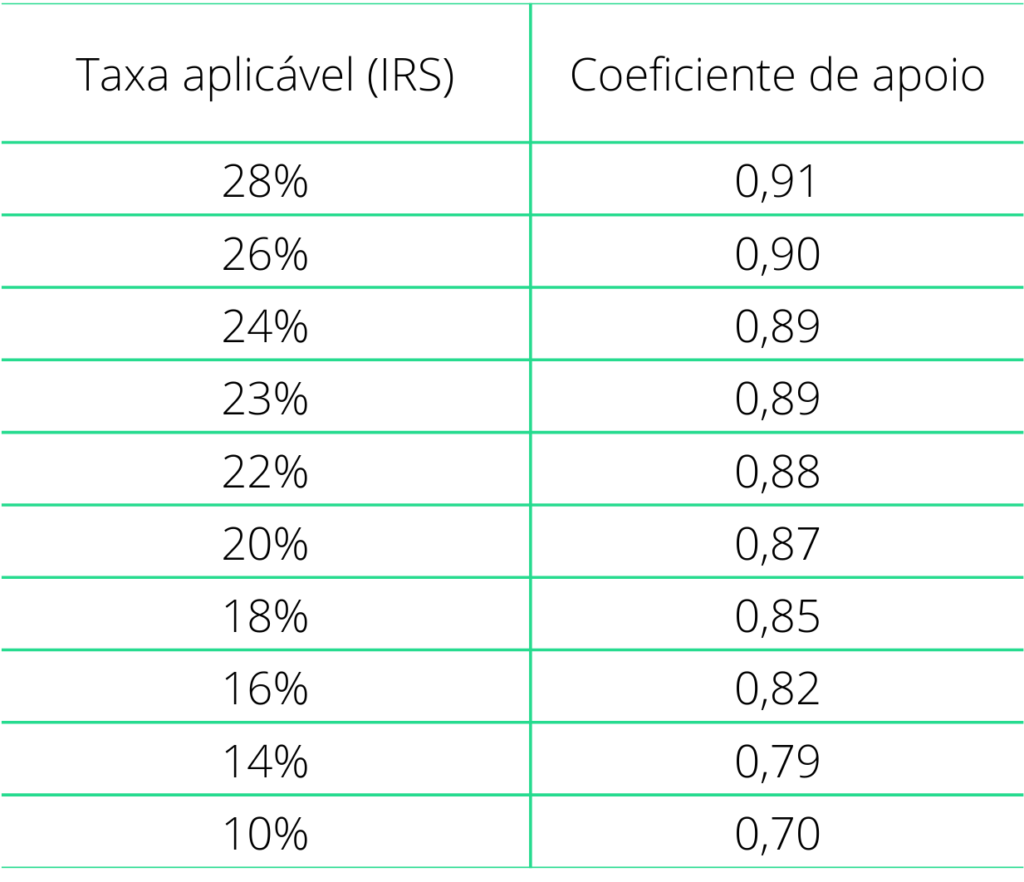

To this end, the government has created compensation with tax benefits for landlords, reducing IRS or IRC rates (depending on whether they are individuals or companies).

Rental contracts signed in 2022 will see a rent increase of 5.43% in 2023, as the price update rule will continue to apply to these contracts, which stipulates that the average inflation rate for the year ending in August of the previous year is used.

With regard to contracts concluded between 1990 and 2021, it is already known that there will be a increase limit set in the 2%.

The law stipulates that landlords affected by the imposition of a ceiling on the updating of 2% rents will receive a discount on the rate of IRS or IRC they will have to pay.

If we add this discount, the final amount of income received by the landlord will be very close to what he would have received if he had increased the rent by 5.43% as the law dictates.

How the rent update is calculated

To find out how much rent you could pay, based on the annual rent update coefficient, take the update for 2023 and multiply the current rent by 1.02.

(Example: 350×1,02=357€)

If the amount needs to be rounded up, this should be done to the cent, e.g. a rent of €350.766 should be rounded up to €350.77.

Communicating increased income

Notice of the rent increase must be given in writing by the landlord at least 30 days before the date of payment of the new rent, by means of a separate draft.

Communication by letter must be registered, with acknowledgement of receipt, or delivered by hand, with acknowledgement of receipt on the copy and duly signed. The rent can only be updated when the contract has been in force for more than a year, i.e. one year after the start of the contract. We provide a draft that you can send to the tenant here.

What is property income?

For IRS purposes, rents are considered category F income, also known as property income.

You can only be taxed under category F if you have communicated the rental contract to the Tax and Customs Authority (AT) and issued electronic rent receipts. Both procedures are carried out on the Finance Portal, with the exceptions provided for by law.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]