ATCUD is a serial validation code assigned by the Tax and Customs Authority (AT), provided for in the Order no. 195/2020, of 13th Augustthe reality of from January 2023 on invoices and tax-relevant documents. This code is characterised by 8 characters that allow the document to be identified regardless of who issues it and 2 sequential numbers, with the following format: "ATCUD:ValidationCode-SequenceNumber".

You should therefore ask your invoicing software provider to integrate ATCUD in order to carry out the serial communication and obtain the respective validation code from the AT.

How do I notify the ATCUD invoicing series?

Billing series must be communicated by webserviceIt is also possible, but not advisable, to do this manually. In order to make this communication, it is necessary to create or assign this possibility to a registered user on the AT portal, in the area of User Management from the website.

Communicate series via Webservice:

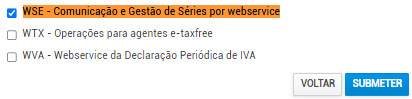

To be able to communicate the series from certified invoicing software, you must first activate the WSE - Communication and Management of Series by Webservice option on the tax portal, as shown in the image below.

Communicate series manually:

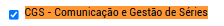

To communicate the series manually directly on the AT portal, you must select the CGS - Communication and Management of Series option in user management.

What will change with ATCUD in 2023?

Companies and other taxable persons using invoicing programmes are obliged to issue invoices, receipts and other tax-relevant documents with the identification of the Unique Document Code (ATCUD) immediately above the QR Code, which must appear on every page.

In practice, certified invoicing software is now prepared to communicate the current and new series via Webservice, electronically communicating the information to the AT portal.

In order for the programmes to be able to start communicating the series, it is necessary to identify the user of the AT portal who has the power to do this. Therefore, you must create (or edit) the user on the AT portal and then register it in your invoicing software.

The data that must be transmitted to the AT are:

- Document series

- Type of document

- Start of the sequential numbering you will use in the series

- Expected start date of the series

Which documents should ATCUD be included in?

Transport documents (waybills) - evidence of the movement of goods under the goods in circulation regime

Conference documents

Receipts - discharge documents that prove receipt.

Who is covered by ATCUD?

All taxable persons with registered office, stable institution or address in national territory and other taxable persons whose obligation to issue invoices is subject to the rules laid down in domestic legislation under the terms of article 35-A of the CIVA and who find themselves (or have found themselves) in one of the following situations:

Turnover of more than €50,000 in the previous calendar year, or in the financial year in which the activity begins, the period in reference is less than the calendar year, and the annualised turnover for that period is greater than that amount.

Have invoicing software

Have organised accounts or have opted for them.

What are fiscally relevant documents?

Transport documents, receipts and all documents issued, regardless of their denomination, which are primarily capable of being presented to the customer and which enable goods or services to be checked, such as delivery notes and receipts, etc.